NEWS

Two new banks in Rep Dom have on-boarded: Banfondesa + BHD

The tide is now rising everywhere and all financial entities are now completing their preparation for their Digital Transformation. It is crucial for all banks to benefit from a solid base in terms of protection of all sensitive assets, as the PAN’s, identification of all payment cards circulating in the market and being stored on remote files, in mobile wallets and leveraged for digital commerce. BHD and Banfondesa have completed their integration tests with VTS, the VISA tokenization infrastructure, thanks to the CUB3PAY platform. They can now start building upon that basement, different use-cases for the benefit of their cardholders. We want to congratulate them for that important milestone and wish them successful digital journey!

Renewal of Certification PCI

CUB3PAY is proud to announce that its state-to-the-art Tokenization platform has achieved certification under PCI DSS 4.0, the global standard for payment security. This milestones underscores CUB3PAY's commitment to providing unparalleled security and compliance in protecting sensitive banking and payment data.

The certification validates the platform's robust ability to tokenize PAN's and credentials while meeting the latest industry benchmarks for safeguarding payment transactions. Businesses leveraging CUB3PAY can now operate with even greater confidence in their payment ecosystem.

CUB3 finalist at OpenFinance 2050 !

CUB3PAY has participated in a major event in México dedicated to the Fintech world: Open Finance 2050.

We met Venture Capitalists, partners, angels and potential customers, all interested in Tokenization which is a growing interest in the marketplace.

Why? Because in front of many FinTechs offering alternate rails of payment, traditional banks need to enlarge their portfolio of digital services: Card on File, Push provisioning to Wallets (Apple, Google …), EMVCo QR, mobile POS.

All these use-cases are mandating Tokenization for solid and secure implementations.

CUB3 is enhancing its portfolio within VISA Ready

Being part of the Ready VISA program is a great chance for accelerating the growth of adoption of Tokenization technologies in LatAm, MEA and all geographies in which CUB3 is active.

Now being a reference across :

- I-TSP (Issuer TSP)

- SRC (Secure Remote Commerce)

- MPQR (QR Payments)

is multiplying the use-cases leveraging the massive adoption of Tokenization of payment credentials.

Join us for all your projects of Wallets, QR payments, CoF, P2P payment, Click2Pay !

Banco Lopez de Haro is now ready for its digital transformation

BLH in Dominican Republic is now live for tokenizing all its payment credentials, in favor of various use-cases in the digital world. Anticipating the introduction in Dominican Republic of Apple-Pay and Google-Pay, which are mandating tokenization of all payment cards, the bank will rely on a secure CUB3 platform (I-TSP) for protecting those assets for the benefit and trust of the cardholders.

Partnering with Mastercard in MEA & Latin America

Such a partnership is a great WIN-WIN situation because CUB3 is helping Mastercard issuers in different geographies to adopt Tokenized transactions. In parallel Mastercard is benefiting from CUB3 capabilities to enable its affiliates quicker and more efficiently.

With Trust, professionalism and controlled budget, financial institutions are embracing Tokenized roadmaps!

Banco Alaver (Rep. Dom.) leverages CUB3 for its suite of digital services

After 60 years of successful operation in Dominican Republic, the rhythm of migration to digital services is increasing for Banco Alaver. For performing top of class services with the highest grade of security, it was mandatory to install a robust and powerful engine (Issuer-TSP) for tokenizing its payment credentials. This phase has ended and entered in operation and the roadmap is contemplating other use-cases which leverage the tokenization, as pushing those credentials into third-party wallets (soon to be active in Rep. Dom.)

Webinar VISA/CUB3 for easy adoption of Tokenization

La Tokenización (VTS) permite que los consumidores realicen sus compras en línea con tranquilidad, sin tener que exponer y compartir sus datos sensible. Por su parte los emisores se benefician de la seguridad que los tokens agregan al ecosistema, reduciendo el riesgo de fraude, los costos operativos en que se incurren para salvaguardar información sensible y experimentan un incremento en los índices de autorización y conversión de sus transacciones, promoviendo una experiencia de compra sin fricción y posicionándose entre sus clientes como la mejor opción al momento de pagar!

En Visa reconocemos la importancia de que participes en la Tokenización y por eso hemos trabajado con nuestros socios tecnológicos para facilitarte el proceso de adopción de esta tecnología!

Tenemos una oferta para ti!

|

Te invitamos a participar de este webinar, donde estaremos compartiendo información como:

|

PROSA & CARNET have partnered with CUB3 for Tokenization

CUB3 Tokenization platform operational in Quito, Ecuador

For the benefit of all payment stakeholders in Ecuador and nearby countries, the full suite of components from CUB3TECH is now running from an Ecuatorian datacentre in Quito, in the premises of LOGIKARD C.A., a leading provider of payments services in the Andean Pact.

The platform is also pre-integrated with Logikard decentralized personnalisation solution for the specific requirements of Issuers. Neobanks, wallet providers, e-merchants and acquirers can also leverage the service hosted in a fully certified datacentre. Listen to following webinar detailing the implementation:

A winning value-proposition: Social Messaging & Secure Payments

CUB3TECH settled an agreement with SocialCashier® & VoicePay® from ReImagination® Technologies, to promote one of the most awaited use-case in the market: Providing secure acceptance payments processing to Banks and PSP’s in social media (WhatsApp and Facebook Messenger).

Complying with VISA, Mastercard and AMEX tokenization and security PCI-DSS standards, with a pre-integrated and pre-certified platform, deployed for both modalities: Cloud services or on-premises.

Dominican Super-APP: tPAGO

More than 1200 views for HCE-NFC in front of Mastercard simulator

ADQUB3 = new APP for mobile POS

- CUB3 mobile POS solution is dedicated to all businesses down to very small ones, such as kiosks, cab drivers, single proprietors, where a stand-alone solution is all that might be needed.

- CUB3 mPOS transforms a smartphone in a powerful POS terminal able to accept payments from an user mobile wallet and then establish communication with merchant's acquirer in real time to process the transaction as a regular EMV POS payment transaction.

- ADQUB3 has been developed according to the last specifications CPoC™ (Contactless Payments on COTS).

- For further security, CUB3 offers a service of own tokenization to be embedded in the adquiring process.

Digital transformer in R.D. : tPAGO

Trendsetting with Logikard, Ecuador

The market is under a bigger pressure to allow any payment credential to be digitized, tokenized and leveraged in any situation, thru any sales channel.

Our partner in the Andean Pact, Logikard, is bringing another impacting feature : the "instantaneity" !

With this demonstration, you can review in YouCUB3, you will measure the strong value proposition of a tight integration between "Instant Issuance", "Digitization & Tokenization", as well as an interesting Loyalty platform. This doesn't mean that you, as an Issuer entity, needs to implement all the bricks altogether, but the ones which will bring you this "unfair" differentiation you want to propose in a very short-term.

In particular, a first step of simple digitization with dynamic CVV could be "live" in a record time and answer to short-term objectives, as an intermediate step towards a tokenization full journey. Please contact us!

"tPago-Pay"accelerates after Covid

Part of a general uptake of contactless and cardless payments in post-Covid times, tPago in Dominican Republic is accelerating its deployment with a number of exciting features: https://tpago.com/que-es-tpago/ and new level of security.

Happy and honored to protect your transactions AND your health !!!

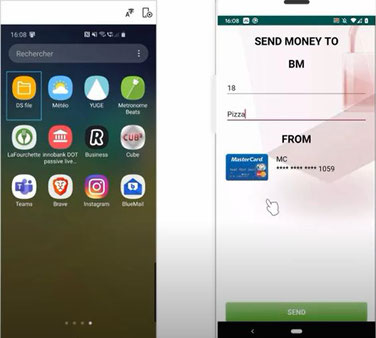

Sending Virtual Cards P2P

We are pleased to offer an exciting new feature with the easiest viral marketing distribution scheme : Leveraging the "contact list" stored in your smartphone, for enabling P2P payments !

Smartphone as the sole customer interface & NO security concession : MOBILE PRESENT

Of course, no plastic issuance, no pre-integrations, piggy-backing upon contactless waves and adding security by consuming dynamic credentials (EMVCo grade tokenized PAN's)

Strong adoption after deployment in Dominican Republic: " tPago-Pay "

Since April 2018 launch, tPago application has now been downloaded more than 100,000 times which demonstrates a strong commercial traction.

Unique features are characterizing this success:

- Universal footprint with USSD technology, enabling 100% phones and smartphones in the market,

- comprehensive portfolio of services,

- extensive network with almost all banks in RepDom,

- and NFC payment in physical shops.

Live demonstration in "Digital Chile"

During last seminar "América Digital Chile", our partners ITECSA and Datacard made a demonstration of combined instant issuance, followed by a notification on the registered smartphone for immediate provisioning in the wallet. This was extremely well received by the community of banks in Chile.

Azul Rep.Dom. adopts tPago NFC

Teaming agreement with Datacard

A strategic agreement with Entrust-Datacard is now in place with CUB3TECH for strengthening the combined Value Propositions of both companies: Issuing the “digital sister” of the instant-issued

plastic card and provisioning it within a mobile wallet, is opening new use-cases and accelerating usage.

In the frame of this agreement, all issuing entities already leveraging

CardWizard™, or planning to do so, will be supported with points of integration for easily enhancing their scope towards mobility and e-Commerce.

tPago launched "Toca y Paga" nation-wide in Dominican Republic in 2018

Since end of 2017, this has been the release of a new generation of this already very successful application (more than 700 K.users !). Many features are important to underline:

- Exceptional portfolio of services

- Connection to almost all local banks

- Operation compatible with USSD (no mandatory smartphone or data-plan)

- Payment based on all accounts: Deposit, savings, and of course debit & credit cards

Please listen to Manuel Grullón from GCS, the company distributing the tPago application and which has teamed with CUB3TECH for generation of tokens and cryptograms and validating them before sending to authorization servers from the banks.

Combining Instant Issuance of cards with tokenized payments

All players in the Payment industry see the potential of tokenized payments, leveraging digitized or virtual cards. CUB3TECH believes that "Instant Issuance" situations represent ideal timing for proposing the loading of these same cards in a mobile wallet, and corresponding Token Services server.

Once the digitized card/account is available , it instantly gives access to:

- NFC-HCE proximity payments

- e-Commerce and m-Commerce

- Any business flow embedding access to the tokenized card

And what about QR codes?

EMVCo released its first QR code specification in July 2017, for consumer-presented QR codes–that is, QR codes consumers can display on the screens of their smartphones or other devices for merchants to scan. And in August 2017, it released specifications for merchant-presented QR codes.

Competitive Pressure: All of the major networks have promoted contactless and NFC for years, but take-up for NFC-mobile payments has been disappointing in many developed countries. And in many emerging countries, the POS terminal infrastructure is too thin to support any kind of meaningful penetration of contactless readers.

Global Interoperability: With a globally interoperable specification from EMVCo, banks or other payments services providers could offer QR code-based payments that could be accepted at a much larger range of merchants–not only those that a particular QR code-based payments scheme signs up. In addition, the global specs would promote a consistent user experience and common security requirements.

The QR code scanner or reader that the merchant uses, decodes and parses the data in the QR code, checks content and formatting and conducts transaction processing before the transaction data is sent via acquirers and the networks to be authorized by issuers.

The specifications state that the reader software must be able to recognize whether the QR code is tokenized and must be able to read the token requestor ID, for further routing for de-tokenization.

CUB3TECH platform is offering now an EMVCo complying platform and full suite of Services, leveraging QR codes since the beginning of its operations in 2015.